- Connect With Us!

- (877) 600-2487

- info@creditsuite.com

5 Business Credit Score Hacks that Can Save Your Business

Published By Credit Suite at April 30th, 2015

Just as you have a credit profile that’s linked to your social security number, your business has its own credit profile that’s linked to its EIN. This credit profile is known as business credit and is one of the best kept secrets in business.

Any business that has an EIN can build a credit profile and score. And once that profile is established, the business will then start to qualify for credit on its own without help or a guarantee from the business owner. This business credit can also be obtained regardless of the owner’s personal credit because the EIN credit is what’s being used for approval.

1. Get your DUNS Number for Free

One of the first steps with building business credit is to obtain a D.U.N.S. number from Dun & Bradstreet. D&B is the largest of the three major business reporting agencies holding more than 10 times more business records than the second largest business bureau Experian. D&B is also the oldest credit reporting agency being founded decades before TransUnion, Equifax, and Experian.

D&B is home to the Data Universal Number System or the D.U.N.S, a nine-digit international business identifying number. In the United States every legitimate business has an EIN number. This number is used to identify your business to such agencies as the IRS and even the Federal and state governments.

The DUNS number is also an identifier number for your business, but it’s used worldwide. Even the United States and Australia require that contractors working for them have a DUNS number; the United Nations requires the same.

Dun & Bradstreet Credibility is a private company that purchases the rights to provide services that were previously only offered by D&B until 2010. One of these services is a Credit Builder program that helps businesses add their existing trade accounts that don’t currently report to D&B to their report so they do.

Dun & Bradstreet Credibility often includes the DUNS number with their Credit Builder program. As a result, many believe that the only way to get a DUNS number is to purchase a service such as the Credit Builder, or other monitoring programs that D&BC provide. But in actuality, due to this number being required by so many agencies and governments, D&B allows a “window” for businesses to obtain their DUNS number at no cost.

You can check to see if your business has a DUNS number, or get a free DUNS number for your business by Clicking Here. Once you click you can setup an iUpdate account with D&BC and get your free DUNS number and take the first step in building your business credit.

2. Quickly and Easily Establish your Business Credit scores using Vendor Accounts

Most people initially establish their consumer credit by using small credit cards, secured credit cards, or getting credit with a co-signer. Business credit is typically established in two different ways.

The first way to build business credit is by paying Dun & Bradstreet Credibility for their Credit Builder program. With this program you can take existing accounts you pay regularly now that don’t report to D&B and get them added to your report. Those newly added reports even tally into your business credit scores.

This is where most people get stuck building business credit, they try to go to stores and cash credit sources first to apply for initial business credit. It’s important to remember that just because you have an EIN doesn’t mean you have credit. You’ll need to obtain some basic accounts first to initially establish credit, and then with a credit score and profile established you’ll be able to start getting store and cash credit accounts.

To establish your initial business credit profile and score you’ll need some really lenient vendors. These vendors must be able to give you credit for your EIN even when you have none yet established. And, you’ll want to find sources who will approve you without a personal guarantee, and ones that can help you even if you are just starting your business.

If this sounds like a tall order it’s because it is, these types of vendors are rare and hard to find. So take advantage of getting access to these preferred sources below because they should meet all of the criteria you’re looking for.

Uline – Uline provides shipping and packaging supplies. These are the types of supplies that most businesses have a use for, so that means you can get access to real credit you need to grow your business while establishing your business credit in the process. They report to D&B and will approve you for new credit without a personal guarantee, even as a startup business.

They will require you to apply for credit, and expect to have you place 2-3 orders with them before they’ll approve you for a Net 30 account… unless you already have some business credit established. So initially expect they might decline you, but if you apply and order a couple more times you’ll typically be able to get approved.

Click Here to get an account with Uline.

Reliable Office Supplies – Every business needs some sort of office supplies. With Reliable you can get the supplies you need while building your business credit with Experian and D&B in the process. Just like with Uline, they might require you order 2-3 times before approving you for a no personal guarantee account, which is unless you already have some business credit established.

Click Here to get an account setup with Reliable.

Laughlin & Associates – Laughlin offers all types of services for your entity. These corporate services include everything from helping you setup your business initially to providing all types of corporate services as you grow. When you do purchase their services they’ll typically approve you for credit on Net 30 terms, and they report your credit to D&B as a tradeline. And, unlike with some other services above, they typically do not make you order a few times before they approve you.

Laughlin & Associates – Laughlin offers all types of services for your entity. These corporate services include everything from helping you setup your business initially to providing all types of corporate services as you grow. When you do purchase their services they’ll typically approve you for credit on Net 30 terms, and they report your credit to D&B as a tradeline. And, unlike with some other services above, they typically do not make you order a few times before they approve you.

Click Here to get an account setup with Laughlin.

Once you get approved for any of these vendor accounts and use your initial credit, it typically reports to the business bureaus within 30-90 days. Once you have five accounts reported you can then start to get approved for store business credit cards.

3. Easily Repair Your Business Credit Scores… at No Cost

In the consumer credit world, the credit reporting agencies are governed by a law known as the Fair Credit Reporting Act. This law dictates how the credit bureaus must handle consumer disputes of inaccurate information.

But in the business world there is no FCRA, or any other law that stipulates how credit disputes are to be handled. As a result, there’s no formal process to dispute information that might be seen as inaccurate on your business credit reports, or at least not one that’s governed by any Federal law. As a result many business owners feel lost, like there’s nothing they can do to repair damage they find on their report.

Entreprenuer.com reports that 90% of business owners know nothing about business credit. This means most business owners are not actively working on building business credit with positive paid-as-agreed accounts. When this happens even one minor negative reported item can have a big adverse impact on their credit score with no positive reported credit to offset the damage. This is one of the many reasons that all entrepreneurs should actively work on building their business credit.

But if you do find items on your business reports that might be inaccurate and are negatively hurting your scores and you want to dispute them, there is a way you can do this with all three reporting agencies.

When sending a debt validation request, your request must be sent to the creditor in writing. Also insure you dispute the debt with the credit reporting agencies if the creditor doesn’t respond to your request. If no response is received within 30 days of mailing the letter directly to the creditor, then you should then dispute the account with the business credit reporting agencies.

To dispute a debt with the business credit reporting agencies, first contact customer service with any of the three reporting agencies for billing disputes, challenging payments and outdated public filings that appear on your report. When you dispute an item the business reporting agencies will have vendors re-verify payments and remove charges if the vendor cannot verify the information.

The business credit reporting agencies can also help to clear up issues that have been settled or dismissed, yet still appear in your report. You may be asked to send in documentation to verify a settlement or dismissal. The business credit reporting agency will then recheck the status of the public filing if you do not have documentation.

Update from Dun and Bradstreet provides US based Small Businesses and Non-publicly traded companies convenient access to D&B’s information on their business. Registered users can view, print, and submit updates to their D&B Business Information Report.

Click Here to access iUpdate.

Equifax Business also has an online system for credit disputing that they provide through their online credit monitoring platform in their member center under “Disputes”. Keep in mind, the business credit reporting agencies may not be allowed to release the name of the person making the negative reference on your report.

Click Here to access Equifax’s credit monitoring platform where you can also dispute items.

Experian prefers to process disputes in writing. Check out This Link to get all of the details you’ll need to start a dispute.

If your debt validation and investigation don’t net you the deletion of the derogatory item, next you need to contact the creditor. Find out from them what you must do to have the item removed from the business credit report. Usually, they will remove the account if you pay the outstanding debt.

The main reason for a derogatory item to be on the report is usually because the creditor feels there is an outstanding balance that you owe them. So they will typically remove the account if you pay the outstanding debt. If you reach an agreement for deletion, get the agreement in writing. And insure they provide you a time frame of when they will correct the damage on your report.

Business credit scoring is based on how you pay your bills. If you pay the majority of reported accounts on time or early, you will have a good score. Most business owners have little to no credit reporting. So even one negative account can have a BIG impact on their business credit score.

It is essential that you continuously build your business credit profile just as you do with your consumer credit. One of the best ways to battle negative information on your report is to offset it with LOTS of positive information. So continuously build your business credit profile just as you do with your consumer credit.

4. D&B Score Hack…Weighted Average

Dun & Bradstreet’s Paydex score is the most widely used score in the business world. This score ranges from 0-100 with a higher score reflecting a better payment history. This score is significantly different than the FICO score most consumers are used to.

The FICO score is actually based on five different components:

Payment History 35% of the total score

Credit Utilization 30% of the total score

New Credit (Inquiries) 15% of the total score

Credit Mix 10% of the total score

Length of Credit History 10% of the total score

Due to the FICO being based on so many factors, it’s complicated and usually takes years of well-disciplined borrowing to get a really good score.

100 Expect Payment to Come Early

80 Payment is prompt

70 Payment Comes 14 Days Late

50 Payment Comes 30 Days Late

20 Payment Comes 120 Days Late

So if you pay your bills on time you’ll get a great score. But what if you don’t pay your bill on time, what happens when you pay your bill late?

That’s when something known as the D&B weighted average becomes very important. The weighted average is a very little known aspect of the Paydex score that has a big impact on your overall score calculation.

The weighted average “weighs” your payment history for larger limit accounts higher than your lower limit accounts. This means if you were to pay your bill late on a smaller $5,000 credit card, it wouldn’t have nearly the same adverse impact to your score as if you paid a $10,000 card late. This means if you’re going to go late, make sure you don’t do it on your higher-limit reported accounts or you’ll see a greater drop in your overall Paydex score.

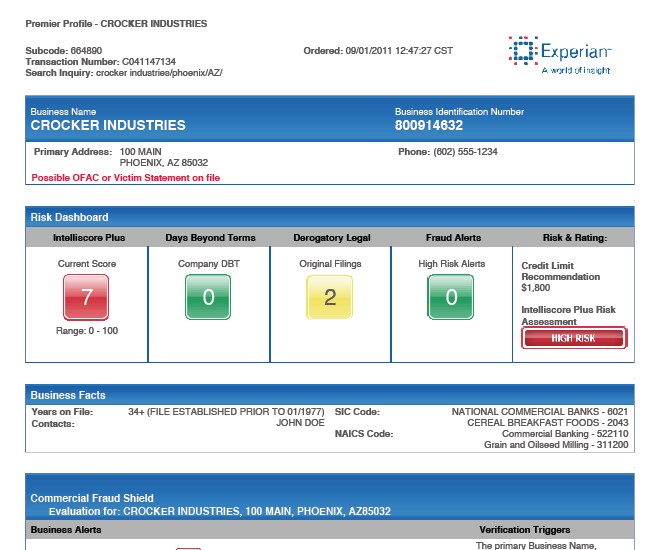

5. Master Intelliscore to Impress the Big Boys

Even though Dun & Bradstreet is the largest of the business reporting agencies, Experian and Equifax also maintain records for companies and issue their own business credit scores. Experian’s Intelliscore is the second most widely used score to determine business risk. And, this is the score looked at by some of the largest credit issuers because some of the largest underwriters of business credit cards only report their payment history to Experian.

The Intelliscore used to function the same as the Paydex score, only being based on payment history. But recently Experian’s updated their score to function similar to a FICO score where there are X factors that tie into the overall score. To truly master your Intelliscore you must first know how the score is calculated, so you’ll know which score aspects require more attention.

Intelliscore Plus is advertised as a highly predictive score that provides a very detailed and accurate reflection of a business’s risk. It actually predicts a business’s risk of going seriously delinquent, or over 91 days late, or having a major financial issue such as bankruptcy within the next 12 months. The score ranges from 0-100 with the higher score indicating a lower risk.

The 0-100 is a percentile score that reflects the percentage of businesses that score higher or lower than the specific business being looked at. For example, if the business has a score of 20, this means that company scores better than 19% of other businesses. That also means that 80% of other businesses score higher than that business.

Intelliscore Plus, just like FICO, has multiple facets to the entire score makeup. The score is still based on the payment history of the business, but many other factors tie into percentages of the overall score. The Historical Behavior or payment history accounts for 5-10% of the total score. Current payment status, trade balances, and percent of accounts delinquent account for 50-60% of the score makeup.

Here’s a better look:

Historical Behavior 5-10% of the total score

Age, Industry, Size 5-10% of the total score

Credit Utilization 10-15% of the total score

Derogatory items 10-15% of the total score

Payments, Balances 50-60% of the total score

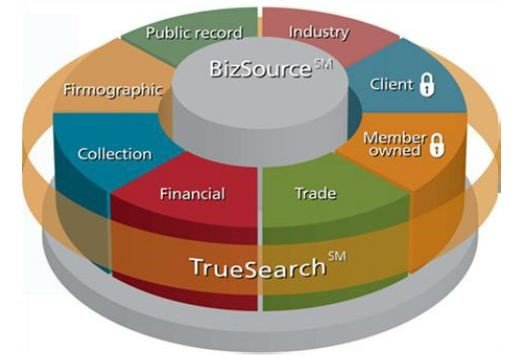

When Experian is assigning a business a credit score they take many factors into account. They refer to these factors as predictive data, and use this data to better determine a business’s lending risk. Multiple factors affect the score, including average balances on accounts, how recent are the delinquencies, what number and what percent of accounts are current versus delinquent, the percent of balances seriously delinquent, the overall utilization ratio, and any balances on leases

Click Here to grab your Experian reports and scores.

Summary

Using these five score hacks you can quickly obtain excellent business credit scores for your company. This helps you get on a path of major achievement and success, because as we all know it’s much easier to build a business when you have access to large amounts of credit and capital.

You can also Click Here for more detailed information on Dun & Bradstreet, Experian, and Equifax and their credit scores.

" class="attachment-blog-single size-blog-single wp-post-image" alt="Get Business Credit Cards for New Businesses Credit Suite-Business Line of Credit Decoded" title="Get Business Credit Cards for New Businesses">>

" class="attachment-blog-single size-blog-single wp-post-image" alt="Get Business Credit Cards for New Businesses Credit Suite-Business Line of Credit Decoded" title="Get Business Credit Cards for New Businesses">>