- Connect With Us!

- (877) 600-2487

- info@creditsuite.com

Some Major Differences Between Personal and Business Credit

Published By Credit Suite at January 30th, 2016

What Are the Differences Between Personal and Business Credit?

Did you know that there are substantial differences between personal and business credit?

What’s Business Credit All About?

There are three main reporting agencies in the consumer world known as Equifax, Experian, and Trans Union. In the business world Equifax and Experian are still players, but it’s Dun & Bradstreet who is the major player.

What About Personal Credit?

In the consumer world the three reporting agencies possess a similar amount of consumer records. This has to do in large part with them splitting up the smaller reporting agencies between them over many decades.

Differences Between Personal and Business Credit: Dun & Bradstreet

But in the business world, D&B has more than 10 times the records of the next closest reporting agency. So

it’s different from consumer credit. Because in the business credit world there really is one major player. And there are two other much smaller ones.

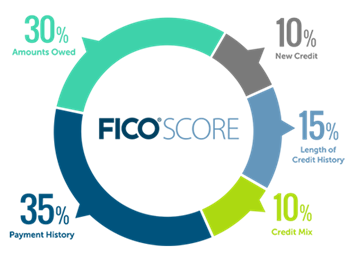

Differences Between Personal and Business Credit: Personal Credit Scoring Factors

Personal credit scoring is based on 5 main factors. So, these are payment history, utilization, length of credit history, accumulation of new credit, and credit mix.

These multiple factors make it hard for an individual to really have a lot of control over their credit score.

Contrast With Business Credit

But in the business world, scores are mainly coming from only one factor, how the business pays its bills. If they business pays its bills on time, a very good credit score is its reward. This makes it much easier and faster for a business to build credit than it takes a consumer to do.

A business can actually build a solid credit profile and score within 90 days or less. And then they can then start qualifying for $10,000 major credit cards. So, they can do so within 6 months.

Personal Credit is Different

In the consumer world, it takes a full 6 months to even get a credit score. And it can take many years of time for a consumer to get high limit credit cards.

Plus, with consumer credit, the consumer is liable for the debt. With business credit the business itself is liable for the debt, not the business owner.

Approval Rates Are Different

Another big difference between personal and business credit is that business credit approvals also are much higher than consumer approvals. On average, approvals are 10-100 times higher on the business side versus consumer side.

Differences Between Consumer and Business Credit: The Upshot

So, these are just some of the major differences between personal, and business credit. Knowing this you can easily see the major benefits any business owner has in having a strong personal credit profile built. But they also need a strong credit profile for their business also.

" class="attachment-blog-single size-blog-single wp-post-image" alt="Get Business Credit Cards for New Businesses Credit Suite-Business Line of Credit Decoded" title="Get Business Credit Cards for New Businesses">>

" class="attachment-blog-single size-blog-single wp-post-image" alt="Get Business Credit Cards for New Businesses Credit Suite-Business Line of Credit Decoded" title="Get Business Credit Cards for New Businesses">>