- Connect With Us!

- (877) 600-2487

- info@creditsuite.com

3 Simple Steps To Raise Your Credit Score

Published By Credit Suite at August 25th, 2016

Yes, You Can Raise Your Credit Score

Your personal or business credit scores can be increased by following this basic three-step approach. Credit is all about painting a positive picture. It doesn’t have to be complex. Aside from the obvious step of paying your bills early and in full, there are a number of other things that you can do to improve your credit. This is how to raise your credit score.

Here’s the Simple Path to Positive Credit Scores for Both Business AND Personal Credit

1. Raise Your Credit Score and Fix Any Errors

If there are any errors or incorrect negative reporting, take the steps necessary to fix them. A lot of people think they are stuck with bad credit. Even victims of identity theft often give up on fixing their credit. That is, when they meet resistance from the consumer credit bureaus. If there are errors or incorrect reporting on your credit reports, you have every right to take the steps necessary to correct them.

2. Raise Your Credit Score and Keep Open Any Accounts in Good Standing

Don’t close accounts that are in good standing. A lot of times, when a person decides they want to take better care of their credit, the first thing they do is call all of their credit card companies. And then they close all of their accounts. This of course backfires, and results in their credit score dropping. This applies to both business credit and personal credit: the more positive history you have, and the more positive accounts you have open, the more available credit you have, the better your credit scores will be.

3. Raise Your Credit Score By Managing Your Debt

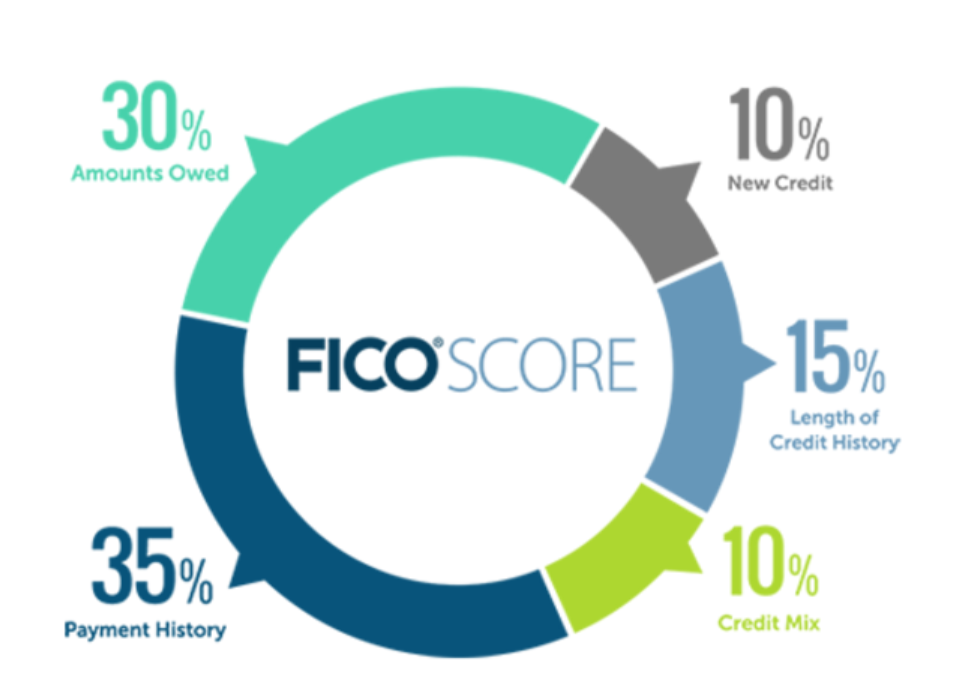

Manage your debt. Your debt to available credit ratio and your debt to assets ratio are key numbers for determining your credit scores. Debt to available credit ratio is for consumer credit. And debt to asset ratio is for business credit.

Keep your debt as low as possible, and don’t max out credit cards or other available credit resources. Use credit wisely and sparingly, and you’ll help paint a positive picture for credit scoring and credit approval purposes.

Takeaways

Is there more to managing credit than these three things? Sure. But the basics are very simple. And if you can manage the basics well your credit score cannot help but improve over the long haul. So take good care of your credit. And then your credit can take good care of you!

" class="attachment-blog-single size-blog-single wp-post-image" alt="Get Business Credit Cards for New Businesses Credit Suite-Business Line of Credit Decoded" title="Get Business Credit Cards for New Businesses">>

" class="attachment-blog-single size-blog-single wp-post-image" alt="Get Business Credit Cards for New Businesses Credit Suite-Business Line of Credit Decoded" title="Get Business Credit Cards for New Businesses">>