- Connect With Us!

- (877) 600-2487

- info@creditsuite.com

6 Smart Reasons to Build Proper Business Credit

Published By Credit Suite at December 30th, 2015

Business credit is credit in a business name that’s linked to the business’s EIN number. This is credit a business owner can obtain that is not linked to their SSN.

When you apply for something such as an auto loan, the lending institution pulls your personal credit using your name, address, and social security number.

This information is sent to the consumer credit reporting agencies, and they supply the lender a credit report with all information they have relating to someone with a similar name, address, and SSN.

With this type of credit an inquiry is then put on your consumer credit report, and your report is used to make the lending decision. Plus, the credit you obtain will then be reported to the consumer reporting agencies.

When you apply for something such as a business loan, the lending institution pulls your business credit using your name, address, and EIN number.

This information is sent to the business credit reporting agencies, and they supply the lender a credit report with all information they have relating to a business with a similar name, address, and EIN.

With this type of credit an inquiry is then put on your business credit report, and your business report is used to make the lending decision. Plus, the credit you obtain will then be reported to the business reporting agencies.

Building your business credit is essential to getting business loans and credit lines. There are also many other smart reasons you should consider building your business credit; let’s take a look at 6 major reasons right now.

#6 Business Credit Has No Impact on the Business Owner’s Personal Credit

When done properly, business credit is obtained without the SSN being supplied on the application. This then allows the credit issuer or lender to only review the EIN number of the business to determine approval.

This means there is no credit check from the business owner to get approved, because no SSN is being supplied to pull consumer credit. This also means that anyone who has bad, even horrible personal credit can still be approved for business credit.

Business credit reports to the business credit reporting agencies, not the consumer reporting agencies.

This means utilizing the account, even over 30%, won’t have any adverse impact on the personal credit scores.

And there are no inquires on the personal credit when you apply for business credit as long as you don’t supply your SSN.

30% of your total consumer credit score is based on utilization so if you use your personal credit to get credit cards for your business, if you use those cards you will lower your scores. Using more than 30% of your limit WILL result in a score decrease

So if your limit is $1,000, having a balance above $300 lowers your scores. This means 40% of your total score is damaged just by applying and using the credit you obtain using your consumer scores. With true business credit, 0% of your score is affected.

10% of your total consumer credit score is based on inquiries so if you are using your personal credit to apply for business loans and credit, your scores will go down as a result of those inquiries.

Plus, those inquiries can remain on your credit for an extended period of time affecting your ability to borrow more money.

And some unsecured business lending sources won’t even lend you money if you have 2 inquiries or more on your personal credit reports within 6 months.

But with business credit, the credit doesn’t report to the consumer agencies, so neither inquiries nor utilization have any effect on your consumer credit scores.

#5 It’s Very Easy to Quickly Build a Good Business Score

Some of the main business credit scores used today including the most widely known Paydex score are based only on whether the business pays its bills on time. As a result, a business owner can obtain credit much faster using their business credit profile versus their personal credit profile.

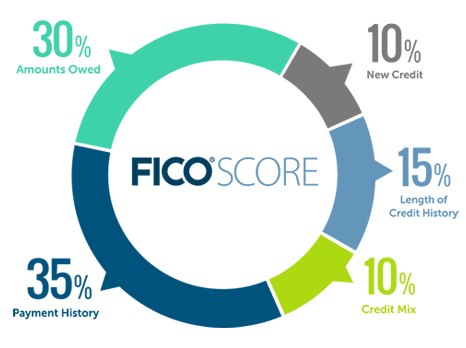

Personal Credit Scores are based on 5 factors:

Payment History 35%

Utilization 30%

Length of Credit History 15%

Accumulation of New Credit 10%

Credit Mix 10%

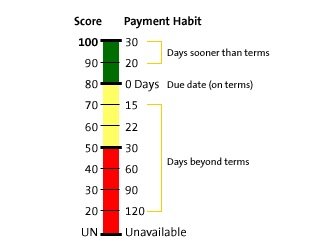

Paydex Scores are based on Payment History:

Expect payment may come early 100

Payment is prompt 80

Payment comes 14 days beyond terms 70

Payment comes 21 days beyond terms 60

Payment comes 30 days beyond terms 50

Payment comes 60 days beyond terms 40

Payment comes 90 days beyond terms 30

Payment comes 120 days beyond terms 20

And it only takes 2-3 reported accounts for you to establish a score, and most vendors have your account reported to the business reporting agencies in 30-90 days.

This means you can build a business credit profile and have an excellent credit score in a VERY short time period.

#4 ANYONE Who Wants Your Business Credit Report Can Pull It

Consumer credit reporting is governed by the Fair Credit Reporting Act (FCRA). And per the FCRA someone HAS to have Permissible Purpose to pull your personal credit, basically they must have your consent to review your reports. Only certain institutions such as banks, auto dealers, mortgage brokers, and others licensed to lend money and approved for credit pulling capabilities can pull your consumer credit report.

But with business credit, this information is made public, which means ANYONE who wants your business information can easily and cheaply get it.

Think about some of the people who can see your reports as they wish whenever they want: customers, clients, suppliers, others who you might do business with and competitors.

Here is some of the information anyone can easily see about your business:

- Amount of tradelines (payment experiences)

- Credit scores

- High credit limits

- Past payment performance

- Employees

- Revenues

- And much more…

… is available to ANYONE who wants it.

Would you want to do business with a company with a similar profile?

What does your profile say about you… are you established?

How will your customers, clients, even competitors think about you with this information?

Keep monitoring your reports regularly to see what others can see about you. And keep building your business credit so you can have a credible image portrayed for anyone who wants to see your credit in the future, especially those who lend money or issue credit.

#3 True Business Credit Can Be Built Without Your Personal Guarantee

When you put your SSN on a credit application, you are almost always providing a personal guarantee.

This means you are personally liable for your business debts so if you were to default on one of these obligations, the creditor will pursue your business assets first, then they’ll come after your personal assets including… your home, your cars, your stocks and bonds, your bank accounts and any and all other assets.

Business owners don’t expect to fail but unfortunately, 90% do fail. It makes no sense to put you and your family’s financial future in jeopardy when you know going in that you have a 90% possibility of ruining it.

Remember, many times the reasons a business might fail have nothing to do with you, or things you can control… such as shifts in the economy so don’t risk it all if you don’t have to.

There is no question, starting and running a business IS risky. This is why most conventional banks make it so hard to get a loan so DON’T use a personal guarantee unless you have to.

One of the best reasons to consider building business credit is separating your personal and business liability so you aren’t personally liable for what happens in your business.

#2 Business Credit More than Doubles Your Borrowing Ability

A major benefit of business credit is that it more than DOUBLES borrowing ability.

You already have consumer credit, now you can have a whole other credit profile with business credit also.

This means it’s the only way to get multiple Staples cards, Office Depot, Lowes, Walmart, Target, and so on… in most cases.

When you have access to more store and cash credit cards, you also have access to a lot more useable money.

Plus, per SBA business credit limits are 10-100 times that of consumer limits. Obtaining business credit radically increases your available credit as a result.

An average Staples card limit on the consumer side might be $3,000, but in the business world it might be closer to $30,000.

This is another reason it’s very hard to scale a business using personal credit only.

Plus, business credit can be obtained VERY fast. You can get approved for initial vendor credit to help your business grow within 1 week. That credit will typically report within 30-90 days.

Once reported you will then have reported tradelines which in turn will give you an established business credit profile and score.

Once your profile is established in 90 days or less, you can then start getting real useable revolving store credit cards.

Within 120-180 days you can then get real cash credit such as Visa, MasterCard, Discover, and AMEX credit you can use anywhere.

#1 No Financials, No Collateral, No Cash-flow… No Problem!

Most conventional and private lenders won’t lend to companies without financials and who have been open 2 years or more and have consistent cash flow.

The most popular cash flow type of financing available today, merchant advances, offered at places like OnDeck requires one year in business and steady revenue for approval.

Other alternative lenders known as asset-based or collateral-based require you have some type of collateral for approval. And almost all conventional loans require you have good personal credit, 2-3 years of financials, and collateral for approval.

Business credit is the only type of credit and financing that’s available for small business owners that doesn’t require substantial cash flow, collateral, tax returns, or good credit for approval.

Business credit doesn’t look at financials, or bank statements. A business even with no cash flow that’s just getting started can be approved for high limit cards, helping them grow their cash flow. And tax returns aren’t looked at either, so even if the business shows a loss they can still be approved.

Most business lending requires collateral. This is because most businesses fail, and the risk of repayment of lent money is VERY high. This is why most conventional lenders make it so hard to get money; they aren’t setup for this type of risk.

This is also why SBA requires ALL business assets, and even personal assets, be used as collateral. Business credit is one of the only ways to get money without providing collateral to offset the risk.

Check out this video that walks through a real customer success story of building business credit to know what’s possible for your business.

" class="attachment-blog-single size-blog-single wp-post-image" alt="Get Business Credit Cards for New Businesses Credit Suite-Business Line of Credit Decoded" title="Get Business Credit Cards for New Businesses">>

" class="attachment-blog-single size-blog-single wp-post-image" alt="Get Business Credit Cards for New Businesses Credit Suite-Business Line of Credit Decoded" title="Get Business Credit Cards for New Businesses">>

2 Comments

I think your program is great for many people who have no idea what to do when starting a business in the US. They don’t know what and how to build credit for them self or their business your model is a god send step by step even if they started wrong they ho back and get it done right with my help thanks

Thank you!